Finance Focus – January Newsletter

February 16, 2023

How to find the mortgage broker that’s right for you

March 21, 2023The Reserve Bank of Australia (RBA) put up interest rates again this month – signalling more repayment pain for variable mortgage holders.

The average Aussie with a $500,000 home loan has seen their repayments jump by about $900 a month since the start of the hikes last May.

While declining property prices and increasing interest rates have scared off some buyers, including many first home buyers, others are keeping an eye out for opportunities in the current climate.

Experts are predicting strategic investors will likely re-enter the market in 2023, as they look to make the most of falling property prices, high rents, tight vacancy rates and the return of migration.

Interest rate news

At its first meeting for 2023, the RBA increased the cash rate by a further 25 basis points. The cash rate now sits at an 11-year high of 3.35 per cent.

“In Australia, CPI inflation over the year to the December quarter was 7.8 per cent, the highest since 1990,” said RBA Governor Philip Lowe. “In underlying terms, inflation was 6.9 per cent, which was higher than expected.”

The move no doubt came as a blow to mortgage holders already feeling the pinch after eight consecutive cash rate hikes last year. And it looks like there may be more hikes to come.

“The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary,” said Governor Lowe.

If you’re considering refinancing, you’re not alone. Back in November, refinancing hit an all-time high ($19.5 billion of loans changed lenders that month), according to Australian Bureau of Statistics lending data.

For those facing a significant and sudden increase in repayments once their fixed term ends, there is even more reason to shop around.

To check how your mortgage compares to others, get in touch with us. We can offer peace of mind and explain whether another lender may have a loan that better suits your needs.

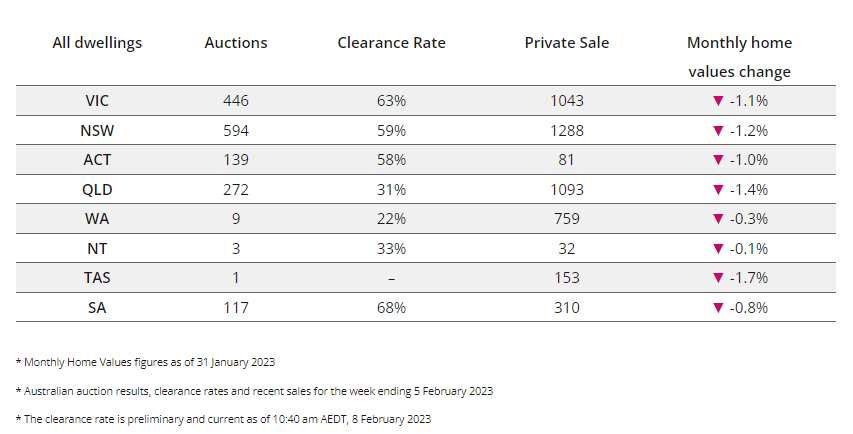

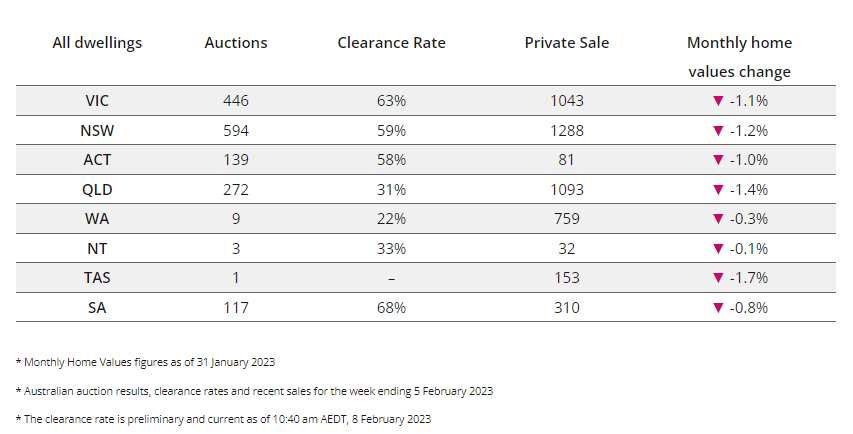

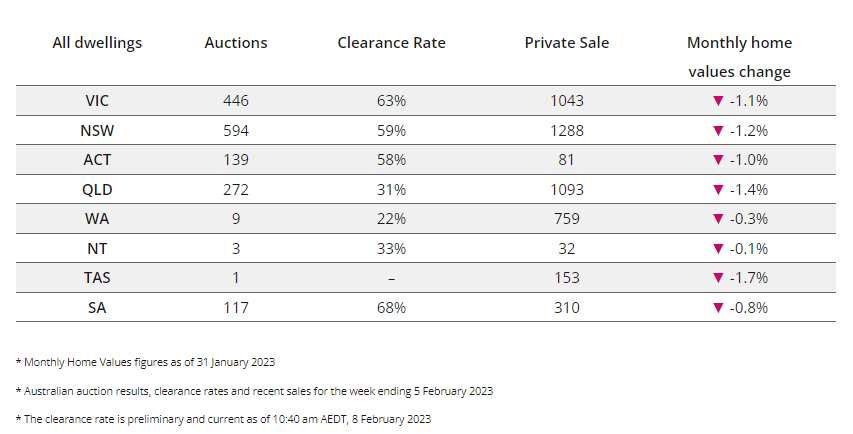

Home value movements

Dwelling values fell across all capital cities in January, led by Hobart (-1.7%) and Brisbane (-1.4%). Perth (-0.3%) and Darwin (-0.1%) recorded the smallest drops.

On a more positive note, the rate of decline in housing values appears to have eased in January, particularly across the premium end in some markets.

CoreLogic Research Director Tim Lawless said although the housing downturn remained geographically broad-based, there were signs some momentum had left the housing downturn.

“The quarterly trend in housing values is clearly pointing to a reduction in the pace of decline across most regions, however at -1.0% over the month and -3.2% over the rolling quarter, national housing values are still falling quite rapidly compared to previous downturns,” Mr Lawless said.

Meanwhile, regional housing values recorded a milder rate of decline than the capital cities in January.

Planning a property purchase in the coming months? Maybe you’re one of the many Aussies looking to downsize to a more affordable property with a cheaper mortgage.

Whatever your situation and goals, we’re here to help. Get in touch today to get pre-approved on your finance.