Home Loans For Healthcare Workers

November 1, 2023

Top camping holiday destinations

November 17, 2023This month the Reserve Bank of Australia (RBA) decided to increase the cash rate. The decision is expected to take some of the heat out of the housing market rebound.

Meanwhile, property prices continued to climb in most capital cities in recent weeks.

If you’re planning a summer property purchase, now is the time to get the ball rolling and chat to us about your finance options.

Interest rate news

It was an unlucky Melbourne Cup for homeowners, with the Reserve Bank of Australia lifting the cash rate to a 12-year high.

The Board decided to increase the cash rate a quarter of a percentage point to 4.35 per cent at its November meeting.

The cash rate had been on hold since June, following an increase of 4 percentage points since May last year.

In a statement, RBA Governor Michele Bullock said inflation was still too high and was proving more persistent than expected a few months ago.

“While the central forecast is for CPI inflation to continue to decline, progress looks to be slower than earlier expected,” she said.

“CPI inflation is now expected to be around 3½ per cent by the end of 2024 and at the top of the target range of 2 to 3 per cent by the end of 2025.”

“The Board judged an increase in interest rates was warranted today to be more assured that inflation would return to target in a reasonable timeframe.”

Another 25 basis points equates, roughly, to an extra $80 per month in mortgage repayments on a $500k loan on top of the $1,040 monthly increase already seen since rates started to rise in May 2022.

If you’re battling with rising repayments, now is the time to chat to us about your options.

We can explore whether there are more competitive home loans available and provide advice about interest-saving features that may help you get ahead.

Home value movements

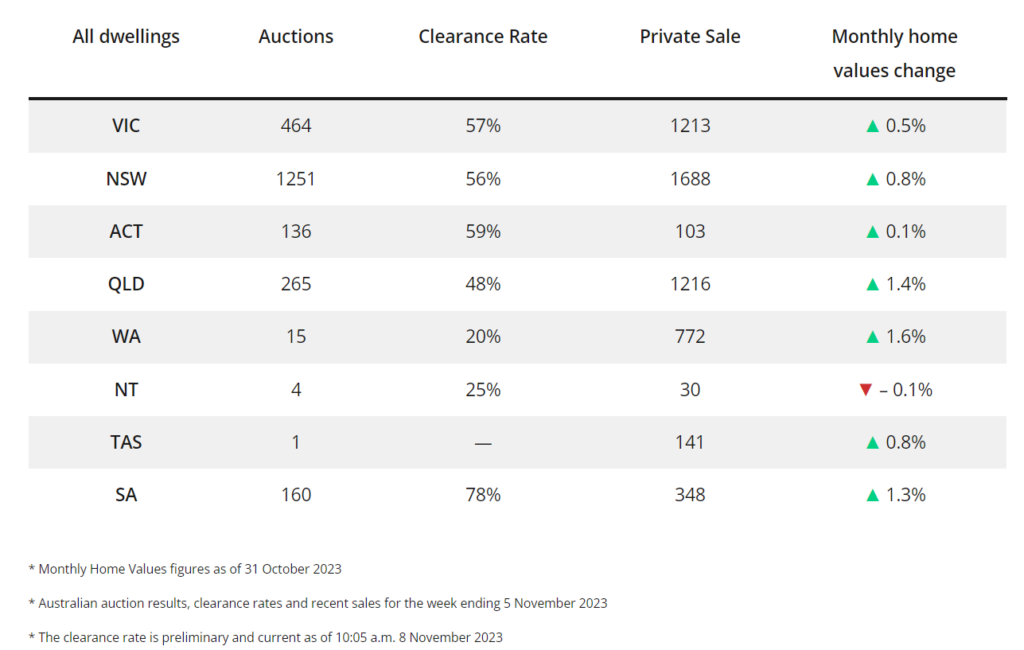

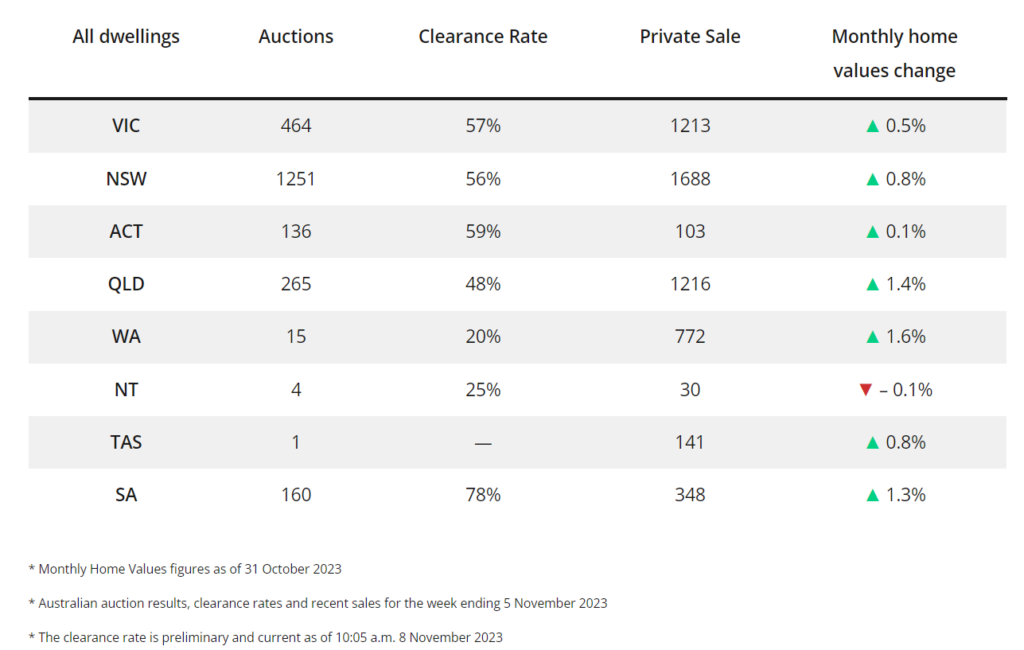

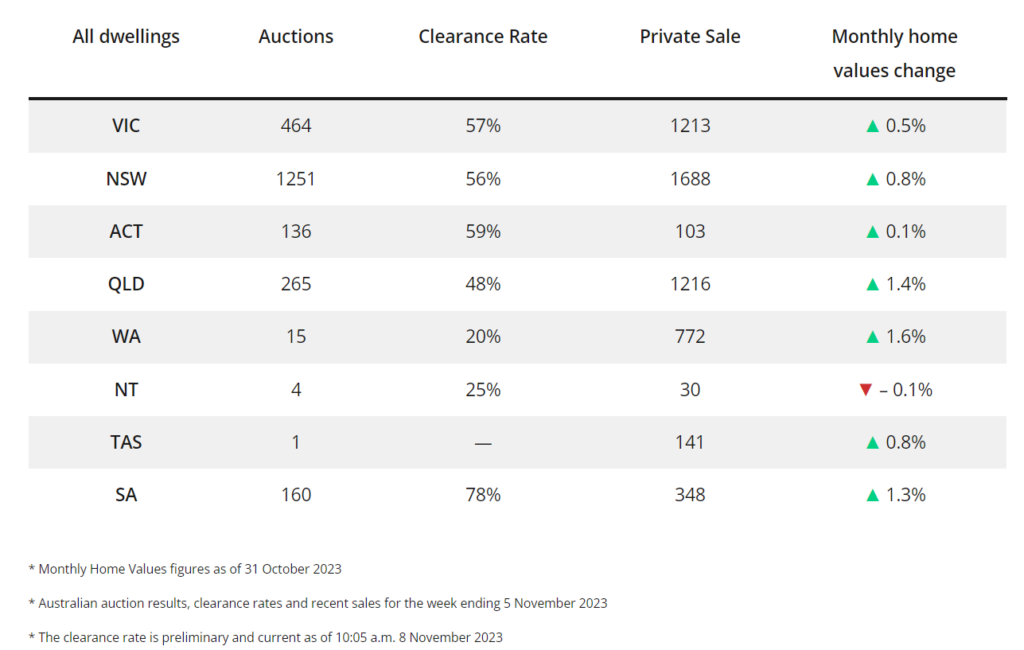

Housing values continued to rise in all markets except Darwin in October. Overall, home values were up 0.9%, according to CoreLogic data.

Perth led the way, with property prices up 1.6%, followed by Brisbane (1.4%) and Adelaide (1.3%).

Although housing values are consistently rising across most capital cities, there’s been a slowdown in the quarterly pace of growth trend.

The three months ending June 2023 saw capital city property values rise by 3.7%. Since then, the growth trend has decreased to 2.6% over the three months to October.

“The slower rate of appreciation can probably be attributed to a combination of higher advertised stock levels alongside stretched affordability,” CoreLogic research director Tim Lawless said.

“With an acceleration in the flow of new listings coming onto the market, it’s unlikely buyer demand will be able to keep pace as we move through spring amid high interest rates and low sentiment.”

Like the idea of being in a new home by Christmas?

Talk to us about arranging pre-approval, so that you’re ready to put in an offer or bid with confidence when you find the right property.

Get in touch today to discuss your finance options.