Whatever stage of the home loan journey you’re in, we’re here to help.

Whether you’re a first home buyer who doesn’t have the benefit of experience, or a property investor who is time poor, buying a property doesn’t have to be a frustrating, exhausting experience.

Don’t waste your energy and resources going from bank to bank!

Parrington Finance is a one-stop service with expertise & experience in areas of lending, real estate, and insurance.

Our team of finance brokers and home loan brokers have the expertise and experience necessary to help you secure the finance you need and potentially saving you thousands on fees.

Our accreditation with 45+ lenders means we can deep-dive into home loan rate comparisons and offer a wide range of finance solutions to meet the needs of first home buyers, property investors and those looking to refinance their mortgage.

Stop dreaming of your dream property.

Let’s achieve it. Together.

Get the Home Buyers Advantage!

Download our FREE Booklet For Assistance With;

- Finding & Selecting the Best Loan

- Buying Tips & Handy Finance Checklists

Are you planning to buy your first home?

Escape the rental roundabout and find a place to call your own — without the heartaches and headaches of a first home buyer. We offer an end-to-end service experience that allows you to compare home loan rates and find the best deal for your circumstances. With our wide array of finance solutions, pre-approved loans, and extensive panel of lenders, you can be confident that we’re the team that can help you achieve your dream of homeownership.

Are you buying your next home?

Whether you’re downsizing or upgrading to a bigger home, taking out a new mortgage can be worrisome and uncertain. At Parrington Finance, we can help you determine your budget requirements and give you clarity around your borrowing power.

Are you looking to invest in property?

Being in the home loan marketplace for 30 years, we know that millions of Australians are buying properties to invest in them. Investing in property has great benefits — from capital growth to rental income to tax benefits. The key is confidently navigating the complex process and ensuring that your loan’s structure matches your tax goals. So before you invest in a property, be sure to get clarity on your borrowing power. Work with us so you can confidently decide on which investment property loan option is right for you. Build your wealth and take charge of your financial future with Parrington Finance

Do you want to refinance your home loan?

Paying a higher interest on your home loan? Refinancing your mortgage is a smart way to shave years off your existing loan and thousands of dollars. Refinancing may sound like a hassle, but it doesn’t have to be. Our experienced mortgage brokers at Parrington Finance can give you expert advice and help you explore the best options for refinancing your home loan.

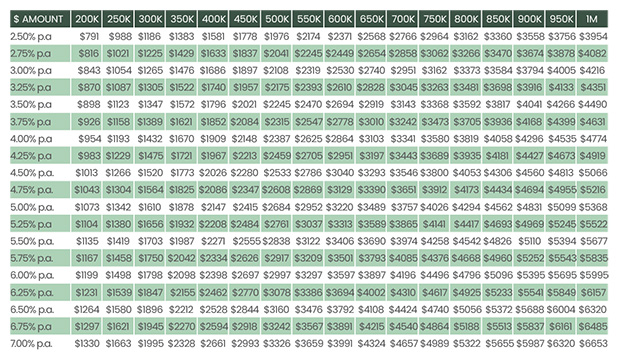

How much will my monthly repayments be?

Use this handy monthly repayments guide while you search for your new home.

What it’s like working with us

Parrington Finance is your local team of finance experts, offering flexible home loans and serving buyers and home owners all over Australia.

We harness the power of technology to ensure you get the best possible experience, wherever you are in Australia.

- Our finance brokers conduct online interviews, making the process safer and convenient for our clients

- As our client, you have access to your own data and documents in our database, enabling you to update in real-time and upload your documents at your convenience

- Depending on the lender, you can track your application process online and in real-time

- You can enjoy getting timely updates from our team during the loan process to settlement

- Our Digital ID Verification capability enables us to work with clients located anywhere in Australia, which is particularly helpful to clients who are living and working in remote locations or engaged in the property buying process whilst on holidays

At Parrington Finance, we understand that buying a home or investing in property is one of the biggest financial decisions you’ll make in your life. As a family-run business, we empathise with the importance of this decision for families in South Australia, the Northern Territory and Australia wide and are committed to simplifying the process for you.

Let’s make your dream a reality. Contact our team today!

Our approach to home and investment loans

For our clients, we offer a personalised holistic approach to lending:

We listen, understand, investigate, and provide a tailored lending solution based on your needs.

As partners on the journey, we endeavour to keep you up to date through timely communication.

We work with an extensive range of lenders to suit your needs. If required, we can assist with an introduction to a Credit Repair Service to provide you with professional assistance if your credit has been impaired or incorrectly reported, helping you achieve a Credit Score that will be acceptable to the lenders.

We provide Mortgage Protection information and referral service so that you can make informed decisions when considering the protection of your most valuable asset — your home — during the home loan process.

We can provide General Insurance quotes to cover Building, Home Contents, ect.

You can compare a range of lenders, rates, and costs associated with your lending to ensure you are getting the most competitive deal or deal that suits your needs.

Interest rates do not always provide the most competitive offer. Understanding of the loan costs is paramount to your final product choice.

Education and consultation are important in everything we do. We will take you on the journey with us, clarifying the financial jargon and making sure you understand what can, at times be a complicated process.

Apply for a home loan with Parrington Finance

The confidence and peace of mind you need is in knowing you have someone in your corner who has a deep knowledge of lending policies.